I wake up this morning happy with the world, my wife is gorgeous, I do not have to work today and I have a great weekend planned. The only thing that has even peeved me this morning is the reality disconnect invovled with gasoline pricing (Thanks USAToday for all the news heh). When Oil was $40 a barrel, I was buying gas for $0.96 a gallon, filling up my 15.4 gallon tank for under $15.00. Zoom forward ten years to 1996. Now the same 15.4 gallon tank at $3.10 a gallon takes 45 bucks but oil is at $70 a barrel. Now the math here is simple to me, a 75% increase in their raw material costs equates to a 222% increase in end product. HEY! WTF?

Okay, lets say that the Bush Administration had imposed new environmental regulations that increased costs (LOL) then I would understand some of it. But other than some mandated fuel mixture changes that the industry knew about more than a decade in advance there has not been any. Well what about reinvestment, are the oil companies spending billions on R&D working to develop new energy sources? Again, No! Are the Oil companies spending money to upgrade their infrastructure to provide more efficient processing, less loss of material, better envionmental compliance, increased capacity or reliable fuel supply? No, they have not opened a new refinery in a decade and every hurricane crushes their ability to maintain the supply of fuel.

So if they are spending nothing that they do not have to, and their prices are up 222% hrmm I bet that is having an amazing effect on their profit margin (note to self DUH!)

ExxonMobil makes $10.4B in second quarter; oil prices pump up Shell, too

NEW YORK (Reuters) — ExxonMobil (XOM), the world's largest public oil company, said Thursday that quarterly profit surged 35%, pushed up by another quarter of sharply higher oil prices. Net income in the second quarter was $10.36 billion, or $1.72 a share, compared to $7.64 billion, or $1.20 a share, in the year earlier quarter. It was the second largest quarterly profit ever recorded by a publicly traded U.S. company. (emphasis mine)

Now I need to state, I am a firm beleiver that most of the time, a laissez faire policy is the best economic practice, but this is clearly the oil companies practicing predatory and rapacious pricing. When this happens the government needs to step in, just as they did back during the early days of oil companies. We need an anti-trust action because quite frankly the Standard Oil breakup was predominantly about refinery breakup, and there are so few refining facilities today that they are effectively producing the same result.

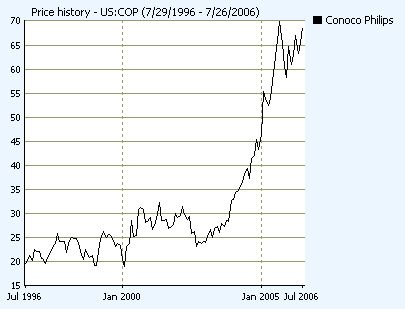

Take a look at the stock value of Exxon and Conoco the last decade;

You can see the raw data at MoneyCentral.msn.com (xom) and MoneyCentral.msn.com (cop). I see some companies in clear trouble here, they must need higher profits to keep up their incredible expenditures! LOL

Really, sigh, there is not much you can do about it. Neither the Democrats or the Republicans really seem that interested. They would rather argue about the meaning of marriage, or simply scream names at each other. I went from Moderate Republican until 96, to leaning left Republican in 2000, then to Libertarian in 2004. I would recommend more of you think about the party that you have selected and consider if they REALLY are what you want. Of the two main choices one cannot beat a man universally reviled as a moron, and the other selected a moron. Is that really what we should choose between? Hell the Republicans have swung so far right, only Michael Moore and logic stops me from considering being a Democrat. Think Different, Act Different, Vote Different.

For a minor aid in finding lower prices you can check out Gas Buddy but to be honest, your gain may not be worth the hassle in terms of numbers, remember at $3 a gallon, 3 cents is only a 1% difference.

I don't want to think about it. It just makes me want to cry. Not because I'm getting ripped off by Big Oil, but because I really don't want to have to walk to the convenience store…